LANSING, Mich. — The same pandemic restrictions that close down movie theaters, bowling alleys and other activity centers are driving increased sales of tabletop games.

“The very fact you don’t have sporting events, you don’t have bars, you don’t have dance clubs, you don’t have all this outdoor, big gathering kind of things, has made some people search for alternative entertainment,” said Ryan Johnson, the co-owner of GOB Retail in Clawson, Michigan’s largest comics and games store.

Board and card games are the-top selling categories of products sold at GOB Retail, Johnson said. Tabletop gaming miniatures and paints are some of his hottest sellers. Board games perform well as they can be played with family members and at small gatherings.

In the second quarter of 2020, American toy and game company Hasbro Inc. reported that revenue for board games increased 11% globally.

Compared to the same six-month sales period in 2019, Hasbro’s total gaming revenue increased 4%, generating $659,497 by June 28 of this year. Hasbro listed sales of both Monopoly and Magic the Gathering as among its most notable sources of revenue.

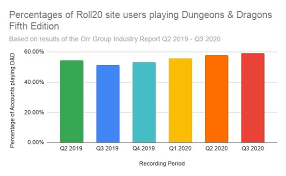

Roleplaying games like Dungeons & Dragons have seen similar demand. The roleplaying game platform Roll 20 reported more games hosted for nearly every title on the site. It reported an 81% increase in the total number of games hosted in the first quarter of 2020.

Sales surged at the height of the government’s distribution of stimulus checks, Johnson said.

While some game shops have closed, most stores with a strong retail component have done fairly well, he said.

“Games help facilitate communication across digital media in a way that existed before but wasn’t necessary,” said Andrew Devenney, the associate director of the Center for Learning through Games and Simulations at Central Michigan University. He also helps publish game books as part of Superhero Necromancer Press.

At Summit Comics and Games in Lansing, Dungeons & Dragons has been a bestseller, according to co-owner Regan Clem. Miniature figure sales are booming.

The newest Dungeons & Dragon book, “Tasha’s Cauldron of Everything,” was likely Summit’s new best seller for the franchise, he said. Sales for other tabletop games are more modest. Classic games like Settlers of Catan and Ticket to Ride saw more sales than newer, more trendy titles.

The increased sales are welcome. Summit closed during the early months of the pandemic, Clem said. Without a significant online presence, sales took a massive dip. But after reopening, sales took off compared to prior years.

“I think people want to support local,” he said.

Game stores are a great place to discover new games, said Joshua Jenkins, 24, of Lansing, who started playing Dungeons & Dragons in college to hang out with friends.

“They’re usually fairly priced there and they usually have a large stock, so most of the ones you’re looking for they’d most likely have,” Jenkins said.

The games market was growing even before the pandemic. In 2019 Grand View Research Inc. reported the global playing cards and board game market size was expected to grow to $21.56 billion by 2025. In 2019, game sales in the U.S. and Canada totaled an estimated $1.65 billion, business magazine ICV2 reported.

Board games represent at least a third of the sales at the Vault of Midnight chain of stores in Ann Arbor, Grand Rapids and Detroit. While mainstay titles like Catan are still popular, newer titles like Wingspan and Root are some of the most sought-after products, said Curtis Sullivan,the co-owner of the Michigan-based chain. Family games like Taco Cat Goat Cheese Pizza have also been hot.

Sullivan also saw increased sales of dice sets and roleplaying games, including independent titles like Monster of the Week, Blades in the Dark and Mothership.

“Being locked up in your house makes you appreciate interacting with folks,” he said. “Whether you’re doing it over Zoom or Discord or whatever, [role playing games] are a way for folks to interact in a different way that maybe we haven’t been doing.”

While interest in games may be up, the pandemic has taken a toll on the business.

Restaurant shutdowns left Michigan’s downtown areas deserted, Sullivan said. People aren’t coming into the store as frequently. Capacity limits have also limited sales.

In past Decembers, the Ann Arbor location would see up to 100 customers in the store at once, he said. That number has now been capped at 18 to limit the spread of COVID-19.

“We’ve been around for 25 years,” Sullivan said. “This will be the first year we haven’t made money. If everything goes as perfect as it possibly could, we’ll have a break-even year.”

And the pandemic may have a lasting impact.

After a quarter-century of brick-and-mortar retail, the pandemic prompted Vault of Midnight to open a web store. Online sales are a lifeline for some game sellers.

Despite opening a webstore in 2016, Hero by Design Studios LLC relied on local game stores and conventions to sell its line of war-gaming products. The online store has since become a key part of the company, said Lee Gaddies, the company’s chief executive officer.

The Detroit-based company saw a 25% increase in sales earlier this year. Sales dropped after August, Gaddies said. While he attributes some of the drop to customers shifting their support to his newest game, Empires Fall, the war-game publisher has yet to see a holiday sales increase.

While online sales have helped sustain the company, they have brought new customers. Gaddies saw increased sales overseas.

“Europe and Australia have kind of filled in where the American market has dropped off,” Gaddies said.

Johnson reported similar results, attributing some of his sales growth to customers who found GOB Retail through its online storefront.

While board games are readily available at most big box retailers, Devenney explained the importance of supporting local game sellers and creators.

“Small press publishers, your local gaming stores or comic book stores… these places can’t weather the severe disruptions that we’re going through right now,” Devenney said. Anyone looking to find new games or comics to entertain themselves should support local game stores and publishers.

“If you want these places to still be around, if you want these small presses and creators to create things that you might get enjoyment out of, you need to support them,” Devenney said.